Corporate

Bond Trading.

Redefined.

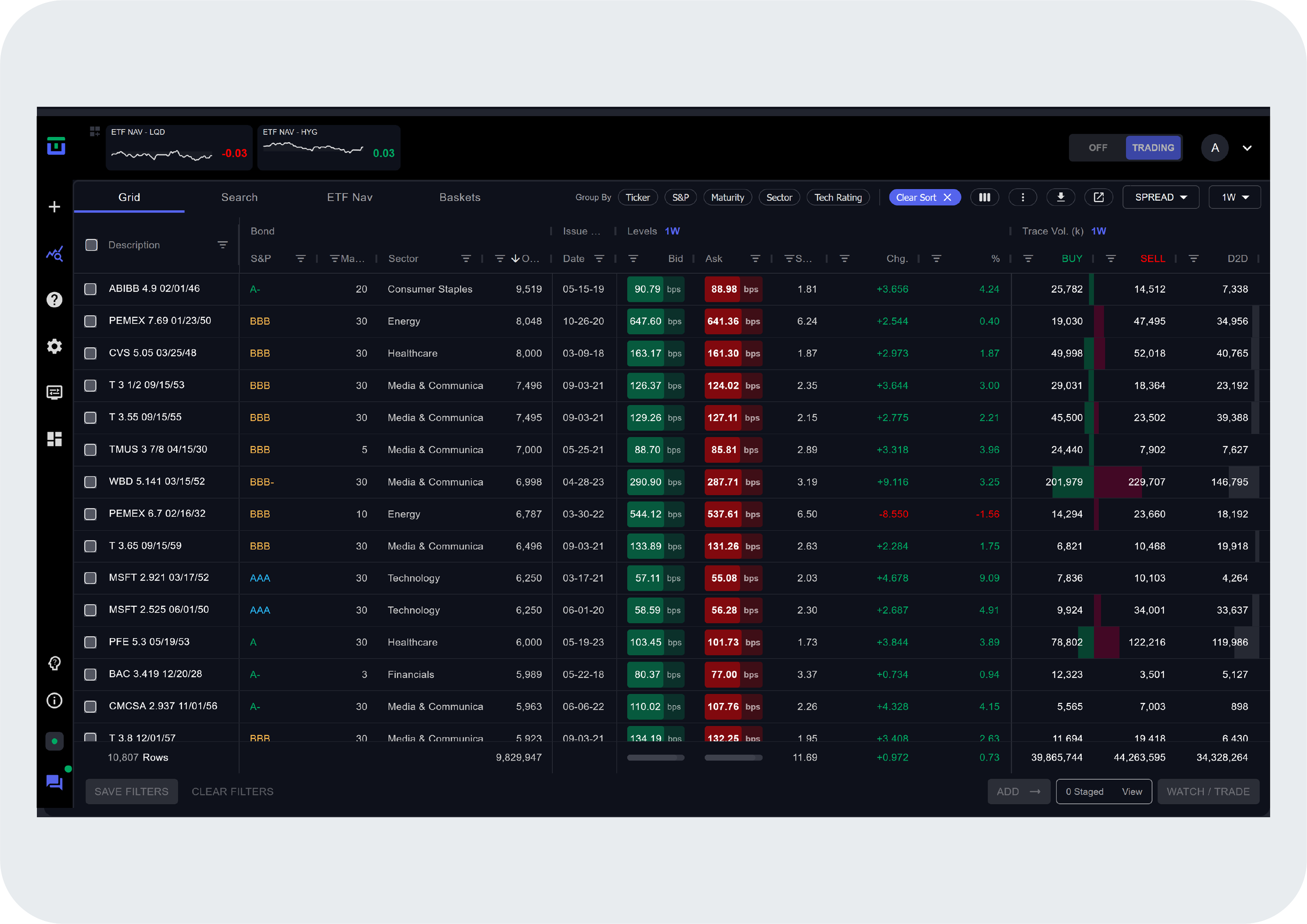

Trading technology to simplify and automate electronic trading of corporate bonds.

Our Solution

-

Simplify Electronic Trading

Access consolidated liquidity

Control trade urgency

Choose manual or automated trading

-

Monitor Market Activity

Detect trends in issuers and sectors

Evaluate liquidity opportunities

Discover new ways to implement trade ideas

-

Track Real-Time Prices

Assess price impacts of market events

Compare relative price dynamics

Understand bond level bid-ask skew